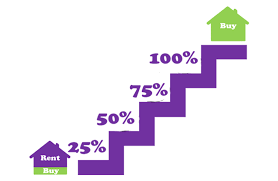

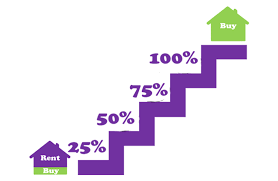

Staircasing is a key feature of the shared ownership scheme, allowing homeowners to gradually increase their share in a property—ultimately enabling full ownership over time. For many buyers who initially entered the market through shared ownership, staircasing offers greater financial control, stability, and long-term investment potential.

In this article, we explore how staircasing works, when it makes financial sense, the costs involved, and how Fraser Bond supports shared owners at every stage of the process. Whether you’re looking to own your property outright or simply increase your equity, understanding staircasing is essential.

Staircasing refers to the process by which a shared owner buys additional shares in their property, usually in increments of 10% or more. Over time, this can lead to full ownership, eliminating the need to pay rent to the housing association.

Staircasing is entirely optional, and owners can choose to staircase partially or fully depending on their financial situation and long-term goals.

Property Valuation

A qualified RICS surveyor will assess the current market value of your home. This valuation determines the cost of the share you intend to purchase.

Notify the Housing Provider

Once you've received the valuation, you notify the housing association of your intent to staircase. They will issue formal documentation and guide you through next steps.

Mortgage and Financing

You'll need to secure financing or mortgage approval to purchase the additional share. Many lenders offer staircasing-specific products.

Legal and Administrative Process

Your solicitor will manage the legal side, including updating lease terms and registering your new ownership percentage with the Land Registry.

Completion

Upon completion, your rent is recalculated to reflect your new ownership level. If you reach 100% ownership, you’ll no longer pay rent (though service charges may still apply).

The more equity you own, the less rent you pay to the housing association—ultimately lowering your monthly outgoings.

As your ownership share increases, so does your equity stake in the property. This can strengthen your overall financial position and resale value.

Once you own 100% of the property, you have full control. You can sell the home on the open market, remortgage freely, or sublet (subject to lease terms).

In a rising market, staircasing allows you to lock in greater ownership before further price increases, thereby improving long-term return on investment.

While staircasing offers many advantages, it comes with certain costs:

Valuation Fees

The valuation is valid for a limited time (typically 3 months) and must be paid upfront.

Legal Fees

Solicitor charges apply for managing the legal transfer of equity.

Stamp Duty Land Tax (SDLT)

SDLT may be payable depending on your cumulative ownership share and property value.

Mortgage Fees

If remortgaging, expect arrangement fees and valuation costs from the lender.

Fraser Bond works closely with clients to ensure all costs are transparent and manageable, helping you budget effectively for each staircasing stage.

Timing your staircasing decision is crucial. Here are some situations when it may be advantageous:

When your financial circumstances improve (e.g., higher income or savings)

When property values are rising and you want to secure a larger stake

When you're planning to sell and want to maximise resale value

When you want to stop paying rent entirely

Fraser Bond offers bespoke financial consultations to help you evaluate whether staircasing is right for your situation.

Fraser Bond provides comprehensive support for shared ownership staircasing, including:

Professional valuations via trusted surveyors

Mortgage advice through FCA-regulated brokers

Expert legal and conveyancing support

Long-term ownership strategy and market insights

Whether you want to staircase once or in stages, our team ensures the process is smooth, efficient, and aligned with your goals.

Staircasing is a powerful feature of shared ownership, offering a path to full property ownership with flexibility and control. Understanding the financial, legal, and strategic elements of staircasing can help you make informed decisions that align with your future.

Fraser Bond is here to guide you every step of the way—from your first additional share to full ownership. Contact us today to begin your staircasing journey with expert advice and trusted support.