Marriage often involves more than emotional commitment—it’s the merging of lives, homes, and most notably, finances. While combining finances may feel like a natural progression for many couples, it’s essential to protect individual assets and clarify financial roles before tying the knot.

A prenuptial agreement provides the legal and financial structure necessary for couples who wish to merge their money responsibly. At Fraser Bond, we support clients navigating this process with wealth, property, or business interests by ensuring their financial union is built on clarity, protection, and legal foresight.

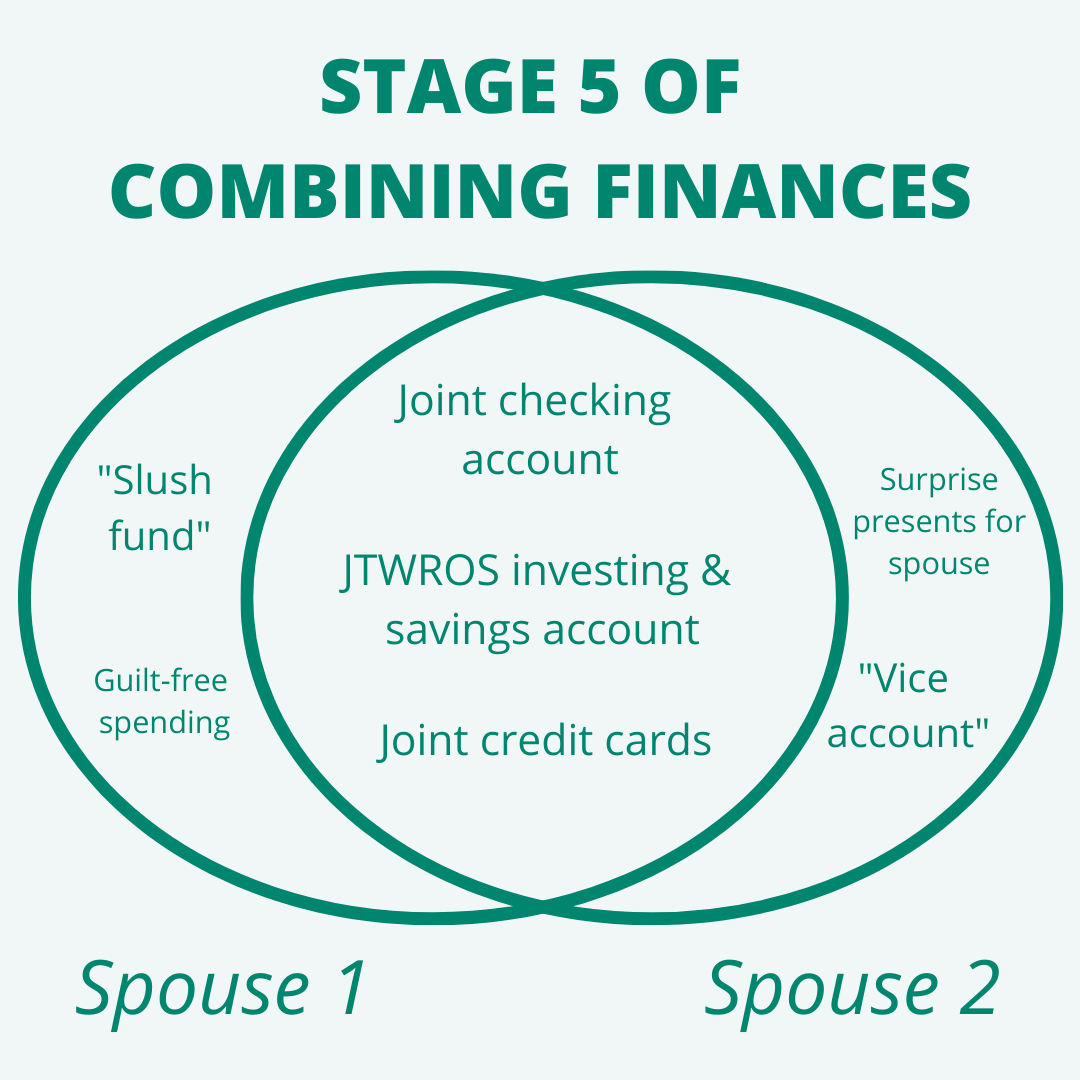

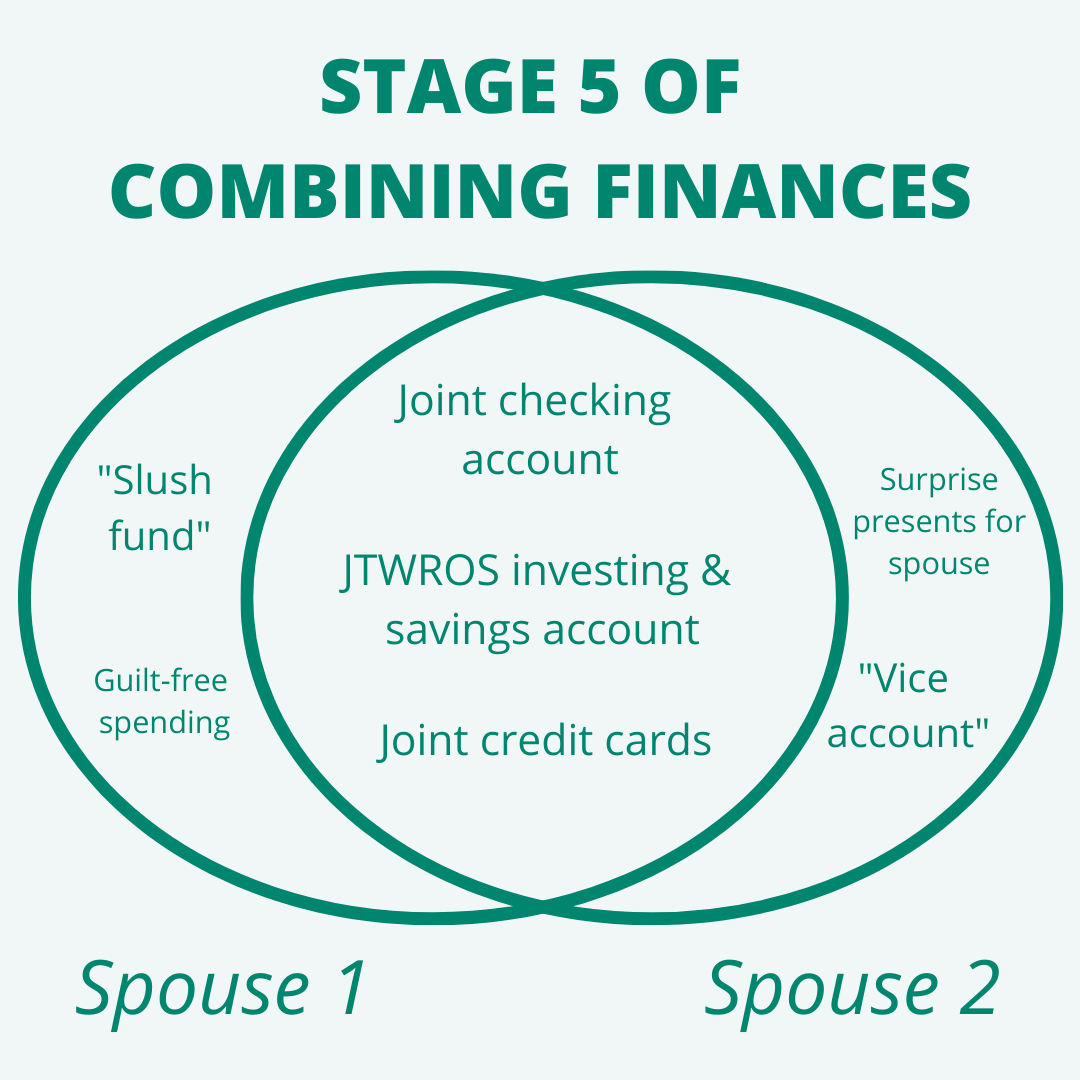

When couples blend income, bank accounts, property, and investments, they face questions like:

What happens to pre-marital savings?

Will property remain individually owned or become marital property?

Who covers shared expenses or debts?

How are joint investments managed or split?

Without a clearly defined agreement, UK courts may treat all finances as jointly owned in a divorce, regardless of how they were originally acquired. This can result in unintended financial loss, particularly for individuals with substantial pre-marital assets.

A prenup outlines what remains individually owned, even after finances are combined.

Establish how household expenses, savings, and debt repayments will be managed.

Whether one party owns a home or both invest in real estate, the prenup ensures fair division and future protection.

Ring-fence inherited assets and family gifts, even if combined income is used to maintain or improve them.

Agree on what financial support, if any, should be provided in the event of separation.

Ownership of bank accounts and investment portfolios

Division of property and mortgage contributions

Plans for joint purchases, including real estate or vehicles

Handling of debt, especially if one partner enters the marriage with more

Terms for spousal support and pension rights

Regular review clause in case financial circumstances evolve

A prenup tailored to combined finances provides transparency and reduces future legal disputes.

To increase the likelihood that a prenup will be upheld by UK courts, ensure that:

Both parties have received independent legal advice

Full financial disclosure is provided

The agreement is fair and signed voluntarily

It is executed at least 28 days before the wedding

At Fraser Bond, we offer:

Strategic consultation on property and asset structuring for engaged couples

Referrals to leading family law solicitors for legally compliant prenups

Coordination with your wealth advisor or accountant to align investment goals and tax planning

Support for couples buying joint property or planning major investments pre-marriage

Our role is to ensure your legal and financial protection matches the complexity of your shared life.

Combining finances in marriage is a major life step—but one that deserves legal and financial clarity. A prenuptial agreement provides a framework for managing shared money, protecting personal assets, and ensuring fairness in the years ahead.

Fraser Bond supports couples with significant assets, real estate holdings, or inheritance expectations to navigate this process smoothly and securely.