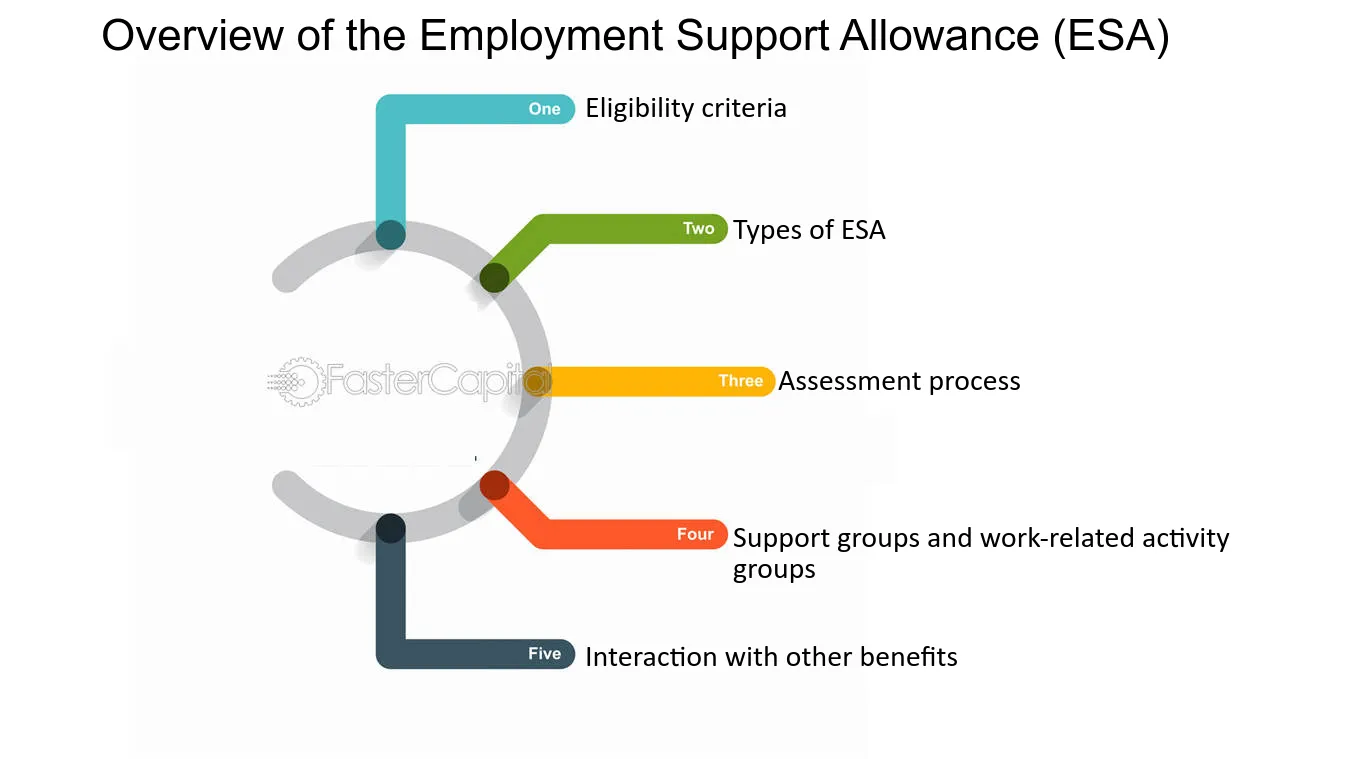

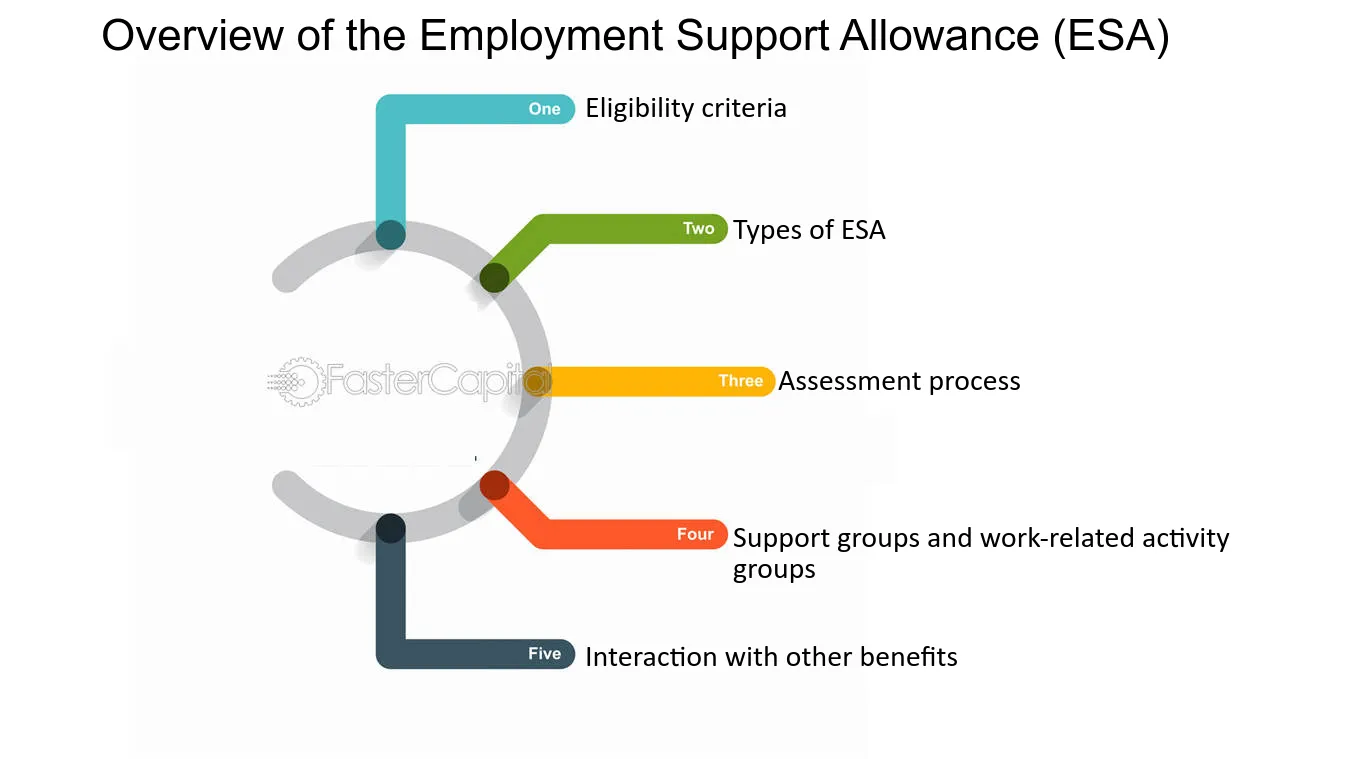

Employment and Support Allowance (ESA) is a UK benefit designed to provide financial assistance to individuals who are unable to work due to illness or disability. The amount you receive depends on whether you are placed in the Support Group or Work-Related Activity Group after an assessment. This article outlines the current ESA payment rates, eligibility criteria, and factors that may affect the amount you receive.

Types of ESA and Eligibility

There are two main types of ESA:

1. New Style ESA

- This is a contributory benefit, meaning it is based on your National Insurance contributions from the past two to three years.

- It is not means-tested, so savings and most types of income do not affect payments (except private pensions over a certain threshold).

- If eligible, you can claim it alongside Universal Credit.

2. Income-Related ESA (Legacy Benefit)

- This has largely been replaced by Universal Credit, but some people still receive it if they were eligible before the change.

- It is means-tested, so your savings, partner’s income, and other benefits can affect your payments.

If you are making a new claim, you will likely apply for New Style ESA, unless you already receive Income-Related ESA.

ESA Payment Rates

ESA payments are divided into two phases:

1. Assessment Phase (First 13 Weeks)

During the first 13 weeks while your claim is being assessed, you will receive:

- Aged under 25: £71.70 per week

- Aged 25 and over: £90.50 per week

After the assessment period, you will be placed in one of two groups:

2. Main Phase (After Assessment)

Once your Work Capability Assessment is completed, you will be placed in either:

| ESA Group |

Weekly Payment |

| Work-Related Activity Group |

Up to £90.50 |

| Support Group |

Up to £138.20 |

- The Support Group receives a higher payment because individuals in this category are not required to seek work due to the severity of their condition.

- If placed in the Work-Related Activity Group, you must take steps to prepare for employment.

Additional Financial Support

Depending on your circumstances, you may be eligible for additional premiums and benefits, such as:

- Enhanced Disability Premium: Available for those in the Support Group.

- Severe Disability Premium: If you receive Personal Independence Payment (PIP) or Disability Living Allowance (DLA) and meet other criteria.

- Housing Benefit or Council Tax Support: If you are on a low income, you may be able to claim additional assistance.

Factors That Can Affect Your ESA Payments

Several factors can influence the amount you receive:

1. Private Pensions

- If you receive a private pension of more than £85 per week, your ESA payments may be reduced.

2. Other Benefits

- Receiving certain benefits, such as Carer’s Allowance or Maternity Allowance, may impact your ESA entitlement.

3. Income and Savings (For Income-Related ESA Only)

- If you have savings over £6,000, it may reduce your Income-Related ESA.

- Savings over £16,000 generally disqualify you from receiving Income-Related ESA.

How to Claim ESA

You can apply for ESA online, by phone, or via Jobcentre Plus. To claim, you will typically need:

- Your National Insurance number

- Your bank details

- A fit note (sick note) from a doctor

- Details of your income, savings, and employment history

For more details or to start a claim, visit the official UK government website:

GOV.UK – Employment and Support Allowance (ESA)

Conclusion

The amount you receive from ESA Support Group is currently up to £138.20 per week, while those in the Work-Related Activity Group receive up to £90.50 per week. The final amount depends on factors such as other income, savings, and private pensions. If you qualify for New Style ESA, it is based on your National Insurance contributions, whereas Income-Related ESA takes into account financial circumstances.

For accurate information on eligibility and payments, it is best to check with the Department for Work and Pensions (DWP) or seek advice from a benefits advisor.