As global demand for digital infrastructure surges, data center services have become a cornerstone of the modern economy — underpinning everything from cloud computing and financial transactions to artificial intelligence and streaming platforms. For institutional investors, developers, and real estate stakeholders, data centres now represent one of the most dynamic and resilient property sectors globally.

At Fraser Bond, we help clients navigate the complexities of this evolving asset class — from sourcing suitable land and development opportunities to providing advisory on leasing, investment structuring, and long-term market positioning.

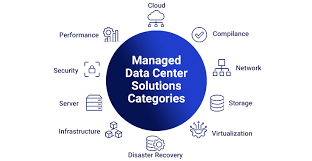

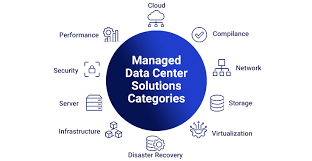

Data centre services refer to the infrastructure, facilities, and managed services that support the storage, processing, and delivery of digital data. These include:

Colocation services (third-party facility hosting customer servers)

Cloud data centres operated by hyperscalers (e.g., AWS, Microsoft, Google)

Edge data centres located near end-users for low-latency applications

Wholesale and retail leasing models for enterprise clients

The physical real estate behind these services — including power availability, connectivity, cooling capacity, and location — is critical to performance and value.

The exponential rise of digital services is fuelling demand for more robust and scalable data centre infrastructure. Key growth drivers include:

Cloud adoption by enterprises and governments

AI, IoT, and high-performance computing

5G rollout and latency-sensitive applications

Regulatory and data sovereignty requirements

As a result, data centre real estate is attracting increasing capital from REITs, sovereign wealth funds, and private equity.

The UK, and particularly London’s FLAP-D market (Frankfurt, London, Amsterdam, Paris, Dublin), remains a leading global location for data centre activity due to:

Dense connectivity and peering points

Robust energy infrastructure

Proximity to financial, tech, and media clients

Favourable regulatory environment

Key submarkets include Slough, Docklands, Reading, and emerging edge locations in Manchester, Birmingham, and along key fibre corridors.

High energy capacity and redundancy (2N/3N) are essential for Tier III and Tier IV-rated facilities.

Proximity to fibre routes, low-latency networks, and enterprise campuses significantly impact value.

Data centres often require specialised zoning. Local authority support and alignment with regional tech strategies (e.g., UK Government’s National Infrastructure Plan) can enhance feasibility.

Long-term tenant agreements with hyperscalers or enterprise clients offer stable income, while build-to-suit developments can be tailored to tenant specifications.

Fraser Bond provides strategic advisory for investors and developers entering this highly specialised sector.

Fraser Bond offers tailored consultancy services to institutional and private clients looking to invest in or develop real estate for data center services. Our capabilities include:

Land sourcing for hyperscale, colocation, and edge facility development

Feasibility studies including power, planning, and network access

Investment structuring for long-term lease agreements or REIT inclusion

Tenant strategy and introductions to data centre operators and hyperscalers

Disposition and exit planning, including forward funding and sale-leasebacks

Our London-based team leverages deep real estate expertise and strategic partnerships in the tech infrastructure space to unlock value and mitigate risk.

Data centre services are at the forefront of digital transformation — and the real estate behind them is becoming a critical investment class. As demand intensifies for space, power, and connectivity, opportunities for developers and investors are multiplying. With Fraser Bond’s trusted expertise, clients gain access to high-potential land, partnerships, and insight needed to succeed in the data centre property market.