Buying a property in London is a significant milestone, but the responsibilities extend beyond exchanging contracts. One of the first practical tasks new homeowners and investors face is switching utilities. Managing electricity, gas, water, and broadband providers efficiently ensures a smooth transition and avoids unnecessary costs.

In this guide, we’ll walk you through how to switch utilities after buying a London property, highlight key steps, and show how Fraser Bond supports property buyers in handling post-purchase logistics seamlessly.

Utility management might seem secondary compared to property buying itself, but mishandling it can result in:

Paying for services you do not use.

Defaulting onto expensive standard tariffs.

Disruption in essential services like electricity, gas, and water.

For London homeowners and investors alike, ensuring control over utility accounts is essential for cost efficiency and property management.

Upon gaining possession, take photographs of:

Gas meter

Electricity meter

Water meter (if applicable)

Submit these to the current suppliers to ensure you only pay for what you use from your move-in date.

Often, sellers or estate agents will provide details of current suppliers. If not:

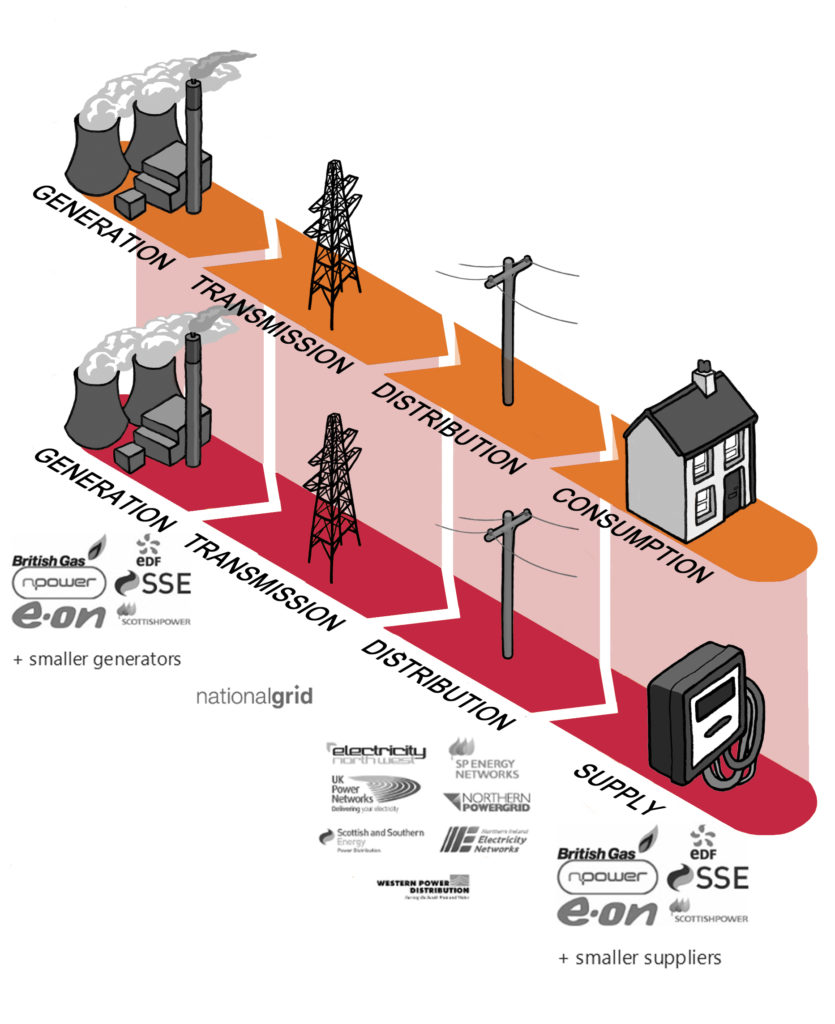

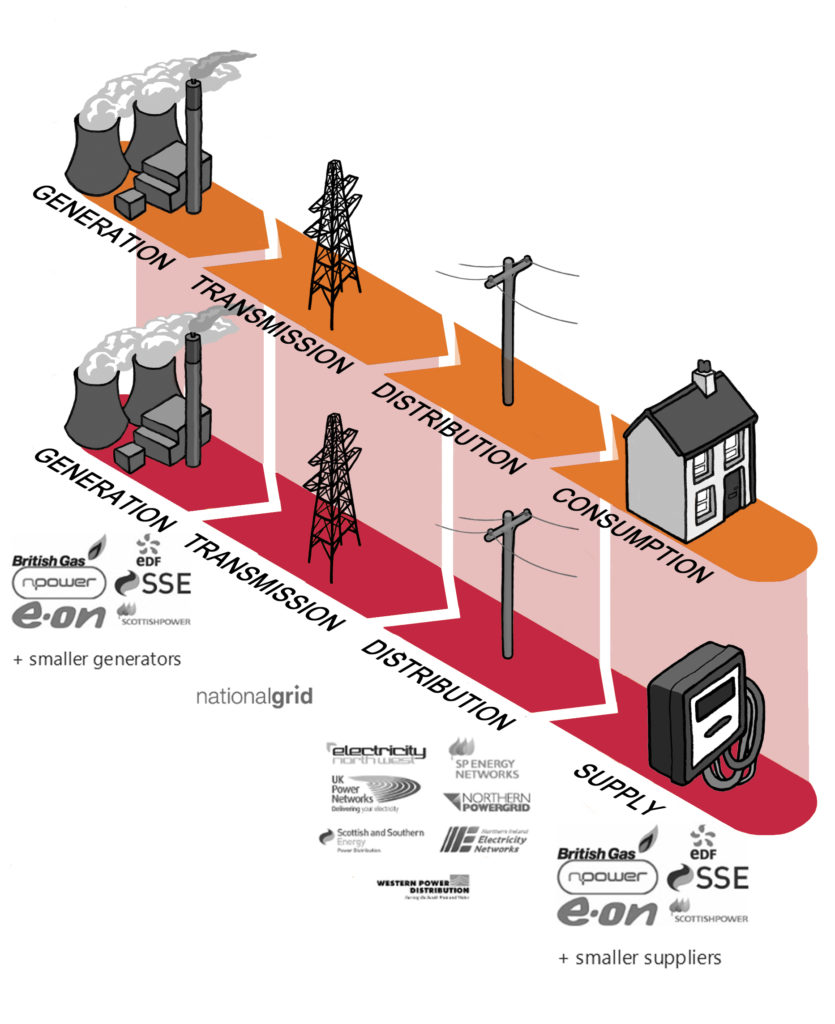

For electricity and gas: Contact the Meter Point Administration Service or UK Power Networks.

For water: Providers are based on the property's postcode (e.g., Thames Water for much of London).

Knowing the existing suppliers is crucial before switching to avoid supply interruptions.

Before switching, you must first set up interim accounts with the existing suppliers:

Provide them with your move-in date and meter readings.

Confirm your billing address and contact details.

This step ensures continuous service while you explore better tariffs.

Use trusted UK comparison sites to find better deals for:

Electricity and Gas (dual fuel packages often offer discounts)

Broadband and TV services

Water rates (where applicable)

Look for deals suited to London properties, where competitive rates and bundled offers are common.

Once you've selected new providers:

Confirm the switching process (typically 17–21 days for energy suppliers).

Keep track of any final bills from the previous providers.

Notify your solicitor (if applicable) to update official property records where needed.

Keep a file (physical or digital) of:

Initial meter readings

Contracts with new suppliers

Correspondence with previous suppliers This will help resolve any disputes or billing errors later.

Council Tax: Notify your local council immediately after completion. London boroughs each manage their own billing.

TV Licence: Even if streaming, a TV Licence is required if you watch live broadcasts in the UK.

Insurance: Ensure your home insurance covers potential utility-related issues like water leaks or electrical faults.

At Fraser Bond, we go beyond helping you find the perfect London property. Our post-purchase support services include:

Advising on reliable utility providers for your new home or investment property.

Facilitating connections with trusted service partners.

Providing property management solutions that ensure your utilities and billing are handled professionally.

Whether you are buying your first London flat or expanding your investment portfolio, Fraser Bond ensures that every part of your transition is smooth and stress-free.

Switching utilities after buying a London property is a critical but manageable task if approached systematically. Taking control of your energy, water, broadband, and council tax accounts early protects your investment and avoids unnecessary costs.

Fraser Bond stands ready to assist new homeowners and investors at every stage – from acquisition to seamless post-purchase support – ensuring your London property journey is successful and hassle-free.